It’s well known that the proportion of M&A deals that fail to create the expected value remains alarmingly high. A survey a couple of year ago from by Aon Hewitt found that nearly 50% of companies had failed to achieve their stated value-creation objectives from the deal. So what’s going on, and what can leaders do about it?

At the heart of value-creation: the culture challenge

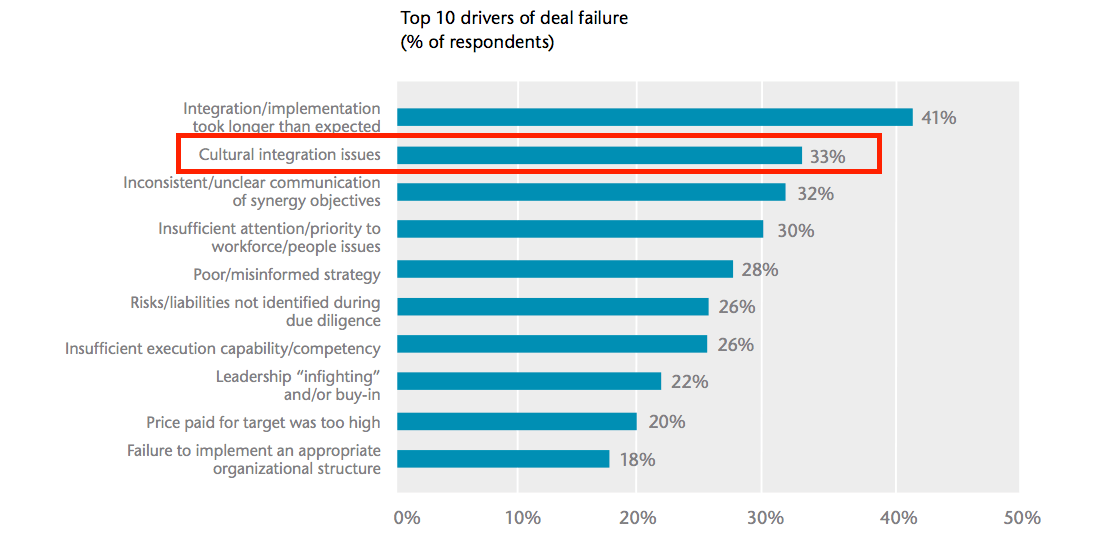

The Aon survey is clear that ‘deal failure’ (failure to create anticipated value) comes from a variety of drivers. What is interesting is that factors #2, #3, #4 and #8 are solidly people factors. Indeed, mismanaged cultural integration ranks as the second leading cause of deal failure.

Poor cultural integration is also identified as an underlying driver to delayed integration (the #1 cause of deal failure), productivity loss, key talent loss, exeucution issues and poor employee engagement.

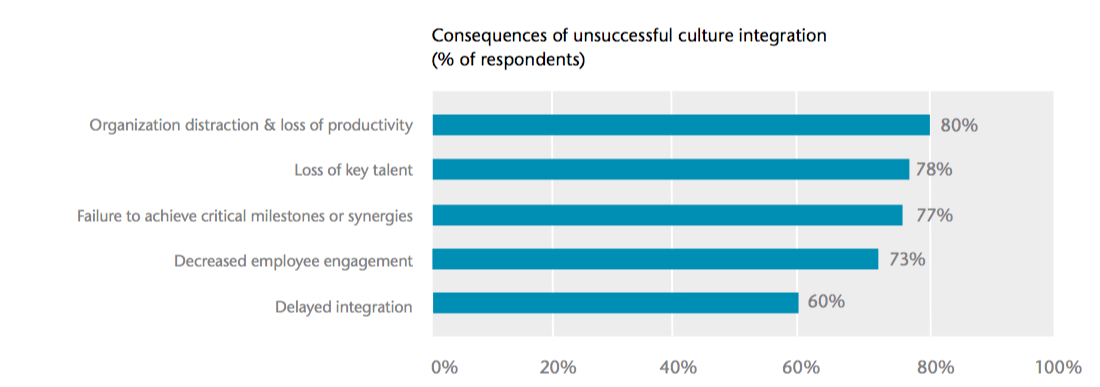

Mercer’s Cultural Integration Snapshot Survey of 199 organisations produced similar findings: Cultural integration issues had negatively impacted at least $1M of value in over 70% of cases, and over $5M of value in almost 25% of transactions.

Bain concurs. The consulting firm identified missed targets, loss of key people and poor performance in the base business as core drivers of poor post-deal value creation, and commented:

”Many companies wait too long to put new organizational structures and leadership in place; in the meantime, talented executives leave for greener pastures. Companies also may fail to address cultural matters that often determine how people feel about the new environment. Again, talented people drift away.” ~Bain

The Aon Hewitt study puts numbers to the observation from Bain: over 50% of firms lose their key talent after the deal at a faster rate than non-critical talent.

Once more we find that ‘soft stuff is hard’ and results in real financial consequences.

Working on the “drivers behind drivers”

So why is corporate culture so important? Perhaps Dov Seidman, in his book How, provides the clearest definition of corporate culture:

“It’s the way things really work, the way decisions are really made, e-mails really composed, promotions really earned and meted out, and people really treated every day.” Or as I like to say “culture is what happens when noone is looking” ~Dov Seidman

So the questions become:

- do we really care how things get done in this new company?

- is the very real threat of talent dilution a significant business concern?

As soon as we look up from our spreadsheets and realise that it’s real people in real situations who are responsible for generating all these numbers we’ve forecasted, the answers to these questions surely have to be yes.

Put it another way: we may have identified the financial drivers underlying the business (say, sales growth and market share) but we need to work on the drivers behind those drivers.

Here we soon start to come across issues of alignment, trust, motivation, agreed decision-making criteria, empowerment, a shared vision, and so forth. In other words, culture.

Anything else is going to lead to a real-world execution gap.

Cultural integration is more complicated than ever

As we saw before, firms have never been particularly good at capturing full value from M&A, but signs are that cultural integration is more challenging than ever.

Firstly, transactions are more global. Managers are faced with reconciling differences in company culture but also navigating the intricacies of national cultures with which they might not be particularly familiar.

For example, we might be comfortable working with the particularities of our longstanding Indian development team, but what do we need to know to work effectively with the Eastern European development team we’ve just acquired?

Secondly, the pace of business is higher than ever. The pressure is on to see financial results fast. This means that managers need to start to work on culture almost immediately, despite many other pressures. When the desired culture is not clear and reinforced, insecurities, conflict, politics and cover-your-ass behaviour thrive. Needless to say, these characteristics do not make for high-performing businesses.

Thirdly, pioneering business leaders under stress often suffer from organisational myopia. Under the stress of an M&A situation, key leaders typically focus on their areas of greatest comfort. For example, a driving and analytical leader may focus on mission and strategy but not give enough attention to values and leadership roles.

Behind M&A: a true leadership challenge

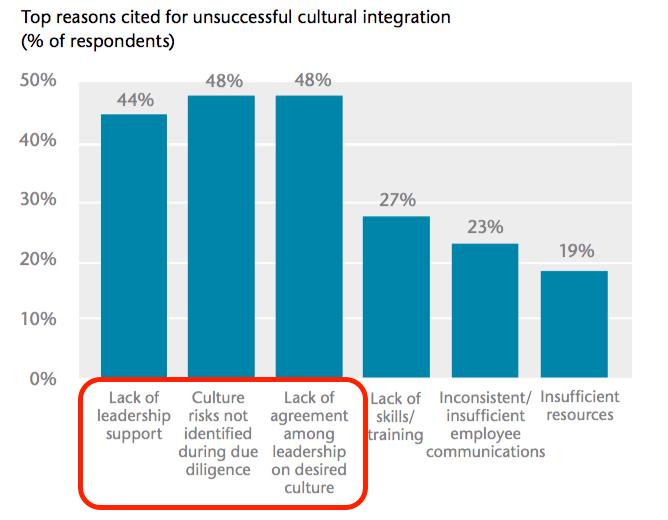

Companies fail to develop an integrated and high-performing culture for three key reasons according to Aon Hewitt:

- Inadequate leadership support

- Poor awareness of the specific cultural risks at play

- Lack of agreement among the leadership of the desired culture.

This rings true for a very specific reason: Leaders define Culture.

Senior leadership must step up and clearly define the culture and embody the culture of the new organisation.

- Define the culture: Understand the true culture of the legacy organisations – the vision, mindset and values actually embodied in the language and practices of employees (rather than whatever the obligatory values statement happens to report). And then define a future culture that represents an attractive and feasible upgrade to both cultures.

- Embody the culture: Leaders define culture, and the true culture of the new company will be created by the actual words and deeds of the senior leadership. In other words, culture cannot be delegated. This requires a level of humility and self-awareness in leaders that is not always found. In practice, we find that an accountability system and a defined process for personal leadership transformation are two key tools in this process.

Summary: “T before M”

In summary, people problems can make or break a post-M&A integration project. Pioneering deal-making leaders need to be careful not to let their own tendencies to focus on the “hard numbers” undermine the success of the deal: the people side needs careful handling if business results are truly to be achieved.

As leaders define culture, the transformation process needs to start at – or close to – the very top of the new company Remember: T before M. Transformation always comes before Multiplication. Otherwise you multiply sickness and not health.

As I’ve seen in my own leadership culture consulting work, when the leadership agrees on and embodies the desired cultural transformation then the new culture can be multiplied surprisingly rapidly across the organisation.

However, if leaders give only lip service to the culture integration process, then what will actually be multiplied is cynicism, confusion and cover-your-ass behaviour.

So yes, ‘hard leaders’ driving M&A do need to take the ‘soft stuff’ seriously….

—

Xquadrant specialises in effective leadership & culture change. If you are interested in learning more about us please get in touch.